There’s a New Tariff in Town

“I am a tariff man, standing on a tariff platform.” ~President McKinley

Tariffs

What is a tariff? When I set out to answer this question for myself, I thought it would be a quick one paragraph answer. After all, a tariff is similar to a tax, isn’t it? It seemed like a basic question with a simple answer but when I started organizing my thoughts, I was overwhelmed with the details. Simply put, yes, a tariff is a tax on products that come into the United States from foreign countries. But there’s much more to it.

Tariffs have been around since our nation’s founding. The Tariff Act of 1789 was among the first bills passed by Congress. According to an economics professor, there are three goals in using tariffs. He calls these the three R’s of tariffs:

Revenue: Tariffs raise revenue to help fund the federal government.

Restriction: Tariffs make it more expensive to import goods from other countries, which encourages purchasing products that are made in the U.S.

Reciprocity: When one country raises tariffs on goods, the other country raises tariffs on their goods. It's a way for countries to "match" each other's trade rules.

Apparently, no President in recent memory has used tariffs in a way to achieve all three objectives, as President Trump wishes to do. That was surprising since it seems logical to use tariffs to raise revenue, return to Made in America, and pay the same percentage others are charging us. In the past, Presidents stuck to the rules of the World Trade Organization, keeping our tariffs low as long as other countries kept theirs low.

After all the research I’ve done on this topic, the most important lesson I learned is that economists, politicians, and the media are doing their best to convince us that tariffs won’t work. The only explanation that makes sense for this is that they can’t allow President Trump to be successful.

The recent drama surrounding the proposed 25% tariff on products from Mexico and Canada provided us with an early lesson of how the Marxists will respond to President Trump’s tariffs. Chuck Schumer spoke on the Senate floor about the damage the tariffs would cause:

“This weekend, President Trump kickstarted a Golden Age of higher costs for American families with his 25% tariffs on Canada and Mexico – two of our four biggest trading partners.

By issuing his tariffs, Trump is yet again rigging the game for his billionaire friends while doing nothing to lower costs for American families.

Thankfully, President Trump got immense blowback, and for now he’s decided to back off on his nonsensical trade war with Mexico.”

Chuck Schumer was not only wrong, but he also lied about why the tariffs were postponed.

On February 1st, President Trump issued a Fact Sheet declaring a national emergency over the threat posed by illegal aliens and drugs, including fentanyl. Citing the crisis, he announced that until the threat is alleviated, a 25% additional tariff on imports from Canada and Mexico will be implemented, and a 10% additional tariff on imports from China.

Schumer announced that President Trump’s reason for adding tariffs to stop fentanyl is “nonsense.” The fentanyl crisis began in 2014, 16 years after Chuck Schumer joined the Senate. If there are other ways to stop the flow of fentanyl, why hasn’t he proposed a viable solution to the problem during his 27 years in office?

It turns out Schumer put his foot in his mouth a little too soon. It wasn’t long before Mexico’s President announced the immediate deployment of 10,000 National Guard soldiers to the southern border. In exchange, President Trump agreed to pause the tariff on Mexican imports for one month. Schumer’s comment for the reason behind President Trump postponing the tariff was a lie.

Canada also quickly came around and announced a $1.3 billion plan to reinforce the border with new resources. In addition to deploying nearly 10,000 frontline personnel to protect the border, Justin Trudeau announced several new commitments to combat the flow of fentanyl. Because of this, President Trump agreed to pause the Canadian tariffs for 30 days. Again, Schumer is lying. President Trump didn’t back down; he negotiated a deal in which Canada agreed to do what he asked them to do.

According to the Fact Sheet, “Tariffs are a powerful, proven source of leverage for protecting the national interest. President Trump is using the tools at hand and taking decisive action that puts Americans’ safety and our national security first.”

When used as leverage for protecting national interests, Canada and Mexico proved to us that tariffs work.

The Tariff Lobby

President Trump recently criticized the “Tariff Lobby” on Truth Social:

He covers a lot of ground in this post including referring to globalists as anti-tariff, the need for Made in America manufacturing, and trade inequities with other countries. He says that we may (or may not) experience some pain. Recently, there has been a great deal of speculation that President Trump may eliminate income taxes. Is this what he is referring to when he says we may or may not feel some pain? If the price of imports increase due to tariffs, will those costs be offset by the elimination of income taxes? Will the pain we feel be temporary while businesses return to America, bringing back jobs and improving our economy?

In addition to his “Tariff Lobby” post, the next day President Trump criticized the Wall Street Journal again, saying that tariffs should have never ended, and he referenced the Income Tax System of 1913:

President Trump says that anyone who is against tariffs are controlled by China or other foreign or domestic entities. This is completely true, and I was able to confirm that for myself while writing this paper. There are forces that do not want the tariffs to be successful, and that is very concerning.

President Trump calls attention to the Income Tax System and its relationship to tariffs. In the early years of the 20th century, the federal government was operating with a surplus. In 1913, the 16th Amendment was incorporated into the Constitution, giving Congress the authority to impose taxes on corporate and individual income. Rather than relying on foreign importers to pay tariffs, the government began their debt-slave system by requiring the American people to pay taxes. Coincidentally, the Federal Reserve Act, which established a central bank to oversee monetary policy and banking, was also signed into law in 1913.

In looking for video clips of President Trump discussing tariffs, I came across a Wall Street Journal video that was posted to YouTube. The video is almost nine minutes long, but I can’t express enough how worthy it is to watch (more than once):

Was it the video’s intention to dissuade us from supporting tariffs? If so, it backfired for me. Although it does its best to convince us that tariffs are not the solution to our problem, the video explains how tariffs led to a surplus in the federal government’s finances. The video explains how the U.S. collected about half of its revenue from tariffs, referring to it as “too much revenue.” The government had a “huge surplus,” and it was a “huge problem.” How is that a bad thing? After the Civil War, tariffs were intended to pay down the debt incurred from the war, which it was able to do, while also leaving a surplus. Again, tariffs worked.

According to the economist in the video, if you pay off all the debt there’s no reason to run a fiscal surplus. Then the government is just accumulating money. Today, the United States is operating under more than $36 trillion in debt. People are struggling, living paycheck to paycheck while trying to make ends meet. Can you imagine if we were able to pay down our debt with tariffs while accumulating a surplus? Imagine the improvements that could be made to our economy, or our infrastructure.

In addition to the video above, the Wall Street Journal released other videos to convince us that tariffs would be detrimental to our economy. Two of those are linked below. Keep in mind that while the videos are informative, they were created by the liberal media. They are not geared toward an America First policy. While it seems their intent is to discourage us from supporting President Trump’s tariff policy, it should work in the exact opposite manner for those of us who are “awake” to the globalists intentions.

How New Tariffs on Mexico, Canada and China Are Hitting U.S. Consumers

This ‘Loophole’ Let $54B of Products Into the U.S. Tariff-Free

President William McKinley

President Trump frequently references President McKinley in his speeches. In fact, during his inaugural address, he declared that he would restore the name of Mount McKinley, which had been changed to Mount Denali by Obama. President Trump said that, “McKinley made our country very rich through tariffs and through talent — he was a natural businessman.”

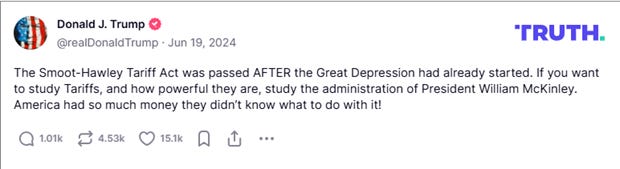

In June 2024, President Trump posted a comment to Truth Social about the Smoot-Hawley Act, President William McKinley, and tariffs.

The Smoot-Hawley Tariff Act was signed in 1930, after the Great Depression began. Since my resources are limited, most of the information I found about this Act was negative. Economists differ on whether the Smoot-Hawley Act had an effect on worsening the Great Depression. Some say its effect was minimal because international trade was a relatively minor part of the economy in the 1930s. The Senate website refers to the Smoot-Hawley Act as "among the most catastrophic acts in congressional history."

It's important to note that the Smoot-Hawley Act was passed in 1930, after the adoption of income taxes and the Federal Reserve Act in 1913. Was it designed to fail to keep the American people under the income tax system?

The Smoot-Hawley Act wasn’t what President Trump asked us to focus on, but rather the administration of President McKinley. William McKinley was a Republican first elected to Congress in 1876. He served as the Chairman of the House Ways and Means Committee in 1889 and built his reputation as a proponent of high tariffs. In 1890, the McKinley Tariff was passed into law. William McKinley, speaking to his constituents, said that the tariff, “will bring to this country a prosperity unparalleled in our own history and unrivalled in the history of the world." The McKinley Tariff of 1890 increased the federal budget, although the exact amount of surplus is difficult to find in our current environment.

Following his time in Congress, William McKinley served as Governor of Ohio and was elected as the 25th President of the United States in 1896. He was reelected to a second term and served until his assassination in 1901.

Prior to running for President in 1896, McKinley considered himself to be a “Tariff Man,” but the ongoing debate over the use of silver and gold as a monetary standard took center stage during the campaign. President McKinley was a proponent of the Gold Standard, which may be another reason President Trump often speaks highly of him. On March 14, 1900, President McKinley signed the Gold Standard Act, which established the dollar's value based on gold and required the Treasury to exchange paper currency for gold coins on demand.

McKinley wanted to strengthen the government while increasing American industry by implementing protective tariffs. A protective tariff is a tax on imported goods to make them more expensive than domestically produced goods. This promotes local manufacturing and stimulates the economy by keeping money in the country. Better explained as - Buy American, Hire American – Made in America.

According to Barron’s, “There’s no denying the U.S. grew rich during McKinley’s years…This was America’s Gilded Age, and immense fortunes were made as the fast-growing nation industrialized.” If you read the entire article, you’ll find yet another example of the media refusing to be optimistic on the potential success of our country.

Common Sense

Our globalist, one world order media has ruined everything for me. The louder they scream, the less I listen. This paper would make any economist want to pull their hair out, because I have no background in economics, mathematics, or history. According to Forbes, 70% of economists are democrats, so that makes sense. What I lack in economics or analytics, I hope I make up for in common sense.

Over my lifetime I have watched as our country has sunk deeper and deeper into debt and despair. Economists, politicians, and the media have had over a century to convince us that tariffs are ineffective, and income taxes are the solution. They have failed. With over $36 trillion in debt, crumbling infrastructure, and the scenes outside of the USAID office we’ve seen this week – the only person who seems to have a plan for correcting it is the guy who wasn’t responsible for any of it. Everyone who had a hand in getting us into this position are criticizing President Trump’s idea for fixing it. The country had a problem with a “huge surplus,” yet economists, politicians and the media tell us that tariffs won’t work. How does this make sense?

This paper was hard for me to write and took much longer than I thought it would. Our media is still useless, and search engines are worthless. Every article I read, every video I watched, every internet search I made contained stories intended to convince me that tariffs will be detrimental to our country. The only person speaking positively about them is President Trump. I’m committed to putting my trust in the one person who isn’t willing to continue going along with the status quo. The one person who wants to fix what is broken.

Why is it that economists, politicians, and the media don’t want our country to succeed?

Made in America

We remember the anger we felt when businesses were moving their operations to Mexico or China. We went from a strong Made in America foundation to importing cheap junk from foreign countries. American companies produced great products right here at home, providing jobs for millions of American workers. If American businesses operating overseas were forced to pay tariffs to send their product back here, would that encourage them to move their business back to America? Creating jobs, eliminating supply chain problems, stimulating our economy. What if we were to rid the burden of taxes from the people and place it on importers?

In 1988, Harvard Business Review published an article titled Manufacturing Offshore is Bad Business. Companies were relocating overseas and making products to ship back to the United States. Manufacturers defended this process by saying it was the only way to compete with inexpensive imports. They said that moving to cheap-labor countries for export back to the United States would allow industry to regain its world standing. They were wrong. The article also said, “Economists generally approve,” which proves that too much emphasis is placed on what “economists” have to say.

One of the reasons so many businesses moved overseas were because of government mandates and regulations. This article was written in 1988, and many of its predications have come true. The destruction of America was very real, and we have a long way to go to build it back. The last people who should have a voice now are the media, economists, and politicians that helped to put us in the position we are in today.

Make America Great Again

Prior to 1913, the United States largely relied on tariffs as its primary source of government revenue. Income tax and the Federal Reserve Act began in 1913. If tariffs are reinstated, we may see the price of some goods increase. What if the rumors that President Trump plans to eliminate income taxes are true? If we are able to keep more of our money, we may not feel the impact of the increase in products, if there are any. Although I’m not a mathematician, I’m pretty sure most people would be okay paying a 25% tariff on a $1 avocado if they could keep 20% of their $100,000 income.

President Trump has done more toward returning our country to its original founding than any group telling us that tariffs are harmful. They’ve had their opportunity to fix what they helped to break. I’m done waiting on them for a solution. There is one person who seems to have a plan that works and I’m supporting him completely. I plan on pushing back on anyone who tries to convince me that tariffs don’t work. I’m tired of being lied to by globalists intent on destroying the dreams this country was founded on.

Excellent information. I'm all for tariffs on foreign-made products and bringing back manufacturing to America. And I'll bet there isn't anyone who wouldn't love to see the IRS and their unconstitutional income tax abolished. Imagine getting to keep the money you work for! I trust President Trump implicitly, and if he thinks we can eliminate over $30 trillion in debt and eventually have an actual surplus by implementing tariffs, then I say go for it. He's already done more for America in his first 3 weeks in office than Biden and Obama did in 12 years, so why on earth would anybody doubt him now?

Pretty good reporting for a “regular gal!” I trust you most because you have common sense and are NOT an economist. Economists use a bunch of jargon that the vast majority of people are befuddled by, and that is by design.the emperor has not been wearing any clothes since 1913. So proud of you for you grabbing these topics by the teeth and not letting them go until they come unraveled. 💗💗💗